This article will explain the average car accident settlement amount. It will consider both accidents which resulted in injuries and those where the main damage was to the vehicle. We will also speak about the importance of hiring a personal injury lawyer after an auto accident, even if you have minor injuries.

Related Links

- 4 Ways Car Accident Injuries Can Impact Video Game Streamers

- 3 Rear-End Collision Settlement Examples

- Recent Successes

- $422,395.00 Settlement

Driving has become second nature to most of us. It is easy to forget the risk involved when we get behind the wheel. The potential danger of an accident is always there. It is important to remain alert and drive safely.

A recent study found that 77% of U.S. motorists have been in at least one accident in their lifetime. Additionally, your chances of getting into a car accident are 1 in 366 for every thousand miles you drive.

It is essential to know how settlements work and the average value of cases similar to yours. This will help you evaluate the worth of your case, as the likelihood of a motor vehicle accident is very high.

At Cantor Injury Law, we are committed to helping clients who have suffered serious car accident injuries obtain the compensation they are entitled to. Although nobody wants to find themselves injured after a car accident, we never know when one might occur. If you have sustained injuries in a car accident, it is important to find an experienced attorney who knows the average value of cases similar to yours. In this blog, we explain what you need to know about average car accident victim settlements.

How Car Accident Settlement Amounts Are Calculated

Not all car accident cases will result in the same settlement amount. This is because the settlement amount depends heavily on the wrongdoer’s insurance policy.

Typically, insurance companies use the following criteria to determine payout amounts:

- Fault And Negligence

- Future And Current Medical Expenses

- Severity Of Injuries

- Pain And Suffering

- Lost Wages From Inability To Work

Additionally, the settlement amount depends on the coverage amount of the wrongdoer’s policy. While there are minimum requirements for liability and uninsured motorist coverages in Missouri, a settlement amount also depends on how many people were injured in the accident. Sometimes, the total settlement amount is divided between injured parties depending on the total coverage amount of the wrongdoer’s insurance policy.

The best way to determine the value of your injury case is to have a jury trial and let the jury decide. That can be risky because a jury could award more money, less money, or no money at all, and you will be left with the additional expenses of a jury trial in both time and money. Cantor Injury Law will analyze what a jury is likely to award based on our 30 years of experience, and you can decide how to proceed.

What Affects The Dollar Amount Of Car Accident Settlements?

Important facts to consider are the average settlement amounts for the federal and state levels and that there is no universal settlement amount. This is because each settlement depends on the circumstance surrounding each accident as well as state laws.

Here are some factors that affect car accident settlement amounts:

1. State Laws

Each state has different laws that affect any claim you make after a motor vehicle accident.

Missouri has the following laws:

- Statute Of Limitations: In Missouri, the statute of limitations for filing a lawsuit related to a car accident is five years from the date of the accident. This applies to accidents resulting in injury or vehicle and property damage. However, if an accident results in death, a wrongful death suit must be filed within three years from the date of death (which can differ from the date of the accident). If you wait for more than five years in Missouri, your case likely has no value.

- Reporting: According to Missouri Revised Statutes section 303.040, the owner or operator of a car must report that an accident occurred if it involved an uninsured motorist or if the accident resulted in injury, death, or damage to property in excess of $500.

- Fault: Missouri is an at-fault state, meaning that the driver who causes the accident must provide compensation for anyone harmed due to it.

- Comparative Negligence: In addition to being an at-fault state, Missouri is also a pure comparative fault state, which means that your car accident settlement amount will be reduced by the same percentage as your level of fault in causing the accident. This rule applies even if you’re found to be the more responsible party. The jury determines the percentages of fault. Your lawyer can settle cases after negotiating percentages of fault.

- Insurance Requirements: The state of Missouri requires drivers to have liability insurance of at least $25,000, and every Missouri insurance policy must include uninsured motorist coverage of $25,000. The laws dictate the coverage amounts you’re required to have through your auto insurance policy.

Read our comprehensive guide to learn more about Missouri’s car accident laws.

2. Severity Of Injuries

The total settlement amount is largely dependent on the type and severity of the injuries a motor vehicle accident caused. You must be compensated for all your t physical injuries; it also takes into account emotional trauma and a comprehensive assessment of all harms and losses ( your pain and suffering) as well as lost wages. Economists refer to your injuries as non-economic harms and your lost wages as economic loss.

3. Liability

Whoever is determined to be at fault for the accident is responsible for paying the settlement amount.

However, as mentioned above, Missouri is a pure comparative fault state, which means that if partial liability is determined, your settlement amount is reduced by your fault percentage. For example, if you are granted a settlement amount of $100,000 but it was determined that you’re at 10% fault for the accident, you’re entitled to 90% of the total settlement amount. Therefore, you’ll walk away with $90,000 instead of the full amount.

Minimum Recoveries For Serious Injuries In Missouri

The minimum amount of money you should receive for a serious injury is the policy limits of the defendant driver. The law in Missouri is that the minimum must be at least $25,000. Frequently, a defendant driver has more insurance, and Cantor has collected tens of millions of dollars from individual insurers for cases, including money paid for excess or umbrella coverage.

Missouri also has a Tort Victim Compensation fund. Suppose a defendant causes you serious harm and has little insurance, so you exhaust the insurance policy. In that case, Cantor can apply for and win you up to $300,000.00 more from the Missouri Tort Victim Compensation Fund.

Determining A Car Accident Settlement Amount

The extent of injuries suffered as a result of a major car accident can vary immensely. While some result in broken bones or whiplash, others can result in death. The severity of the injuries incurred as a result of a motor vehicle accident plays into how large the settlement amount will be. Additionally, the amount of any medical bills that resulted from injuries sustained during the accident and the required medical treatment is factored into the amount.

In Missouri, defendants are allowed to receive compensation for loss of income if their injuries render them unable to work. Additionally, if the other driver was driving under the influence, without a license, or was driving recklessly or negligently, it could increase the settlement amount.

Choose Cantor To Maximize Compensation

When you choose our legal team to represent you, our goal is to maximize the overall value of your injury case. This means we will make our best effort to secure a settlement worth more than the “regional average.”

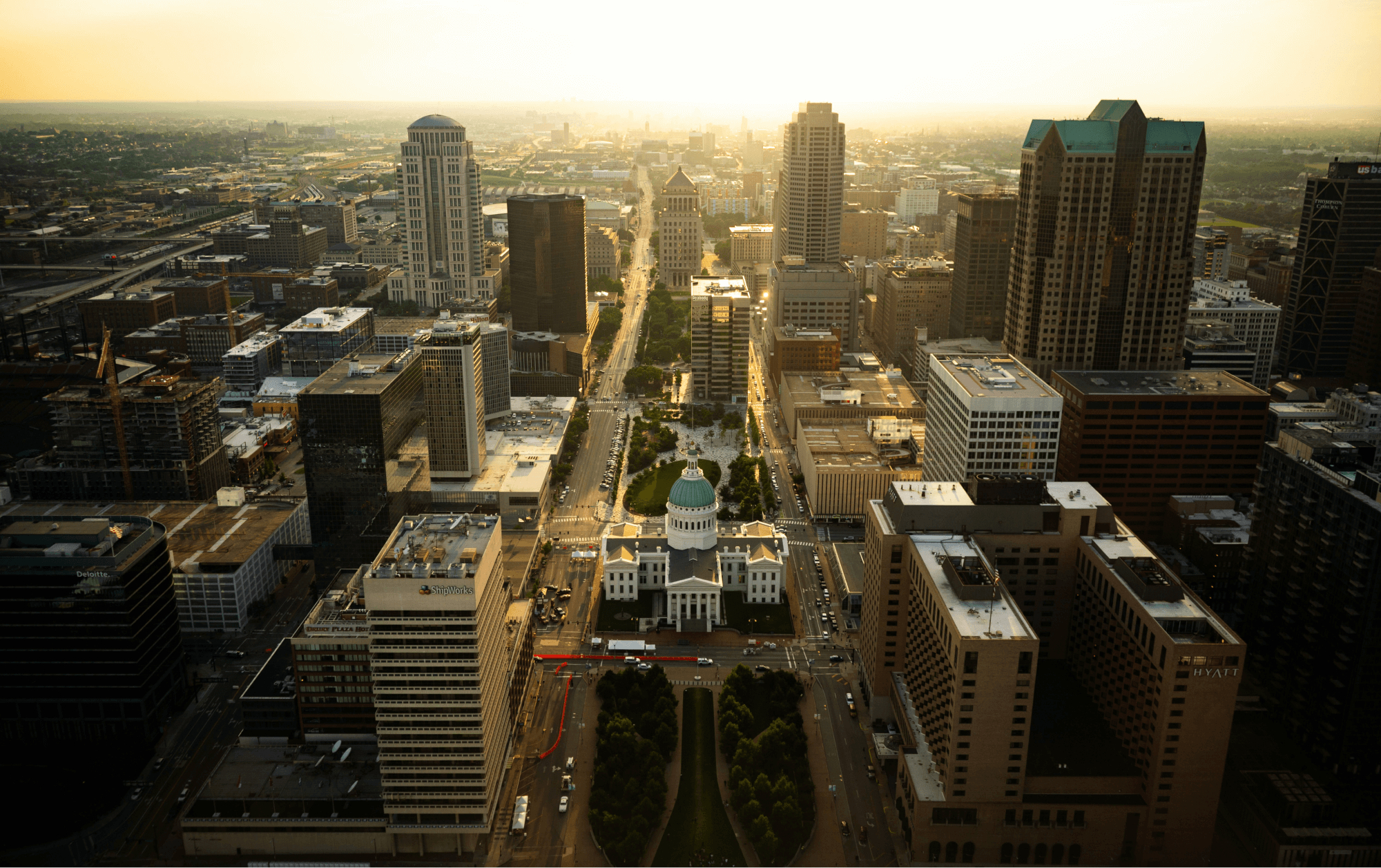

Our legal professionals know what the value of your case is worth because, for the last 30 years, we have dedicated ourselves to helping clients throughout St. Louis with their injury cases. For example, if you have $10,000 of medical care and the person who caused the accident has $20,000 of insurance coverage, your case might be worth $25,000. In Missouri, the average insurance policy available for drivers is $25,000.

This is because drivers in Missouri are required by law to have at least $25,000 of insurance coverage. Every injury case varies because the nature of an individual’s injury changes from case to case. However, the nature of insurance always remains the same.

While you’re attending to your injuries, let an experienced St. Louis Missouri car accident lawyer, like ours, handle the rest. We’ll assist with evidence gathering and communicating with insurance companies so you can focus on what’s important–healing.

Get in touch with us by calling (314) 628-9999 or contacting us online. We offer free consultations and don’t charge any fees until we win.

FAQs: Average Car Accident Settlement Amounts

Q: How Are Car Accident Settlement Amounts Calculated?

A: Car accident settlement amounts depend on various factors, including fault and negligence, future and current medical expenses, the severity of injuries, pain and suffering, and lost wages from inability to work. The settlement amount also depends on the coverage amount of the wrongdoer’s insurance policy and the number of injured parties involved in the accident.

Q: What Factors Affect The Dollar Amount Of Car Accident Settlements?

A: Several factors can affect car accident settlement amounts, including state laws, severity of injuries, and liability. State laws vary, impacting the legal framework and requirements for compensation. The severity of injuries is a significant factor, as more severe injuries typically result in higher settlement amounts. Liability determines who is at fault for the accident and is responsible for the settlement amount.

Q: How Do State Laws Affect Car Accident Settlements?

A: Each state has its own laws that can impact car accident settlements. Factors such as the statute of limitations, reporting requirements, fault determination, comparative negligence rules, and insurance coverage requirements can all affect the settlement process and amounts.

Q: How Does Liability Affect Car Accident Settlements?

A: Liability plays a crucial role in determining car accident settlements. The party found at fault for the accident is responsible for paying the settlement amount. However, in states with comparative negligence rules, the settlement amount may be reduced based on the percentage of fault assigned to each party involved.

Q: How Can An Experienced Attorney Help Maximize Car Accident Settlements?

A: An experienced car accident attorney can help maximize your settlement by assessing the value of your case, gathering evidence, negotiating with insurance companies, and advocating for your rights. They understand the legal complexities and can navigate the settlement process on your behalf, aiming to secure a settlement amount that reflects the full extent of your injuries and damages.